How to Teach Filing Your Taxes

Feb 20, 2021

Our next topic in the Consumer Math Blog Series is about how to teach Filing Taxes. Read more about why and how you can teach Filing Your Taxes using my Filing Taxes Lesson Unit (click here to get your copy).

Purpose of Teaching about Filing Taxes

It’s the law, period. Students should know that it becomes THEIR responsibility once they have a paying job to file their taxes. While I rely on a tax professional to help me, it’s okay for them to start with the basics (like HR Block or a website) to get started. Most likely, their taxes are going to be pretty straightforward and they would need just a little help to tackle the task.

Filing Taxes Lesson Unit

Key-Must-Teach Concepts

April 15th! With the exception of 2020, students should know that this date is the DEADLINE for submitting taxes. It’s not a Start date, or a Suggested date, or a First Draft date, it's the DUE DATE!

W-2! No, this is not like R2D2. It’s an important form and has a lot of personal information that needs to be protected. Students should know that it might be mailed to their house (so don’t throw it away) or can be accessed online (and to get the directions from the manager), either way, it is important to get a copy and to keep safe!

Lesson Objective

Identify and define basic vocabulary related to filing state/federal taxes.

Lesson Unit Break Down

Day 1- Let this day be a calm introduction to a very dense and often highly confusing topic. Spend time emphasizing the importance of learning about this and why your students as wage-earning adults will be required to file taxes. Feel free to lighten the mood with the brain teaser and start the formal, structured lesson time with the visual flow chart. Then, hop to the reading passage (see my Reading Passage Option below), the T/F questions, and the writing prompts.

Day 2- You can start the Notes on Day 1 or save it for Day 2, whatever works best for your schedule. As expected, the Notes is a general introduction and the Parts gets to the lesson’s nitty gritty. The back side of the Parts worksheet focuses on the process of filing taxes, which is important to building a foundation for understanding!

Day 3- Use this day to review the Tax Form visuals and videos. Start or end with the Quick Question and do a whole class review using the File Taxes review OR task cards (again, your choice). See the Task Card Idea below.

Day 4- Again, you can start this lesson off with the File Taxes review or task cards (see Task Card Idea below). Check your students’ level of understanding with the assessment, then move to the functional math review and/or the word search.

Filing Taxes Lesson Unit

Reading Passage Option

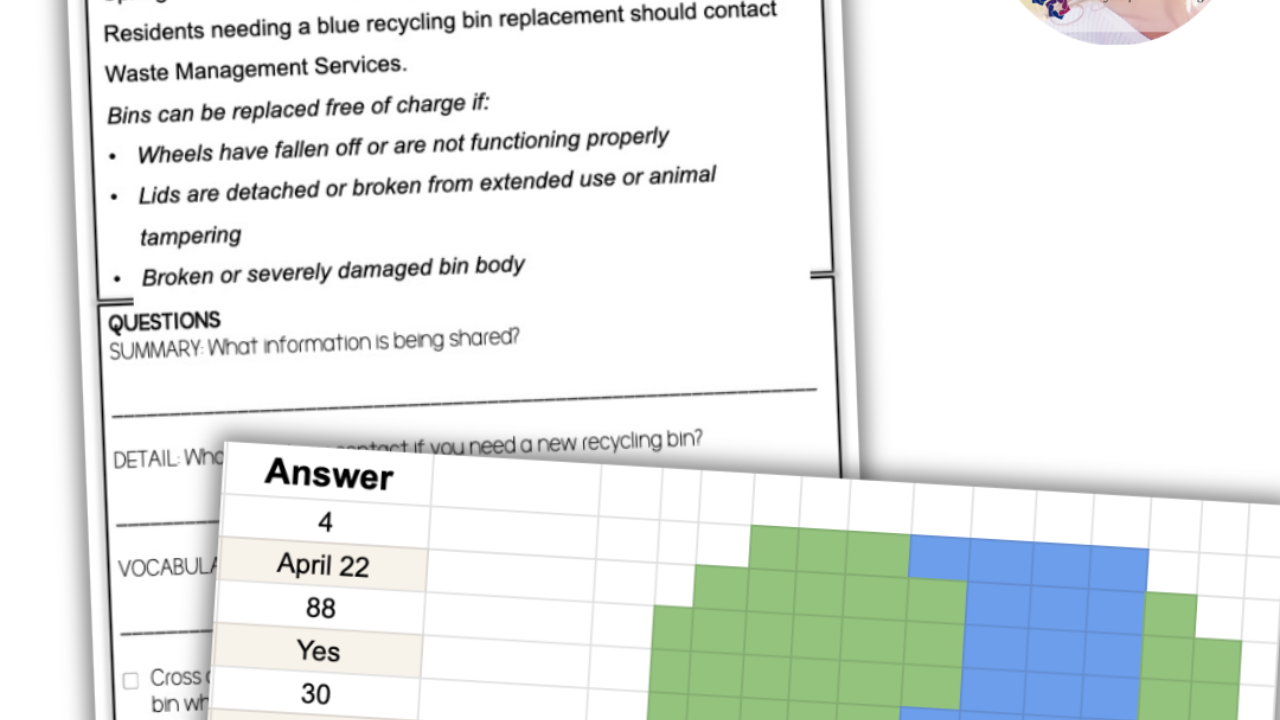

Use marginalia (writing notes about the reading in the margins of the page) to help your students further digest the information. There is a lot of information covered in the reading passage and focuses on all those small details, giving them time through review, and then writing down those thoughts will help to further deepen their understanding.

Listen and Learn

A Listen & Learn is a short, 5 sentence PowerPoint/Google presentation that introduces the topic using visuals and audio. Ideal for non-readers! Read about what they are and how they might be right for your classroom here.

Task Card Idea

If you have a set of Clickers or can figure out a way to have students answer first (like slapping a desk/tap their head/etc, then this may be a fun way to get students active during the learning. Break the class into two teams. Face two desks towards you (the teacher) or facing each other (like Family Feud), and offer up the question (no answer options, unless it is T/F, then preface the question with that). Have students click/slap/tap/etc to give an answer and if they are right, then their team gets a point.

Filing Taxes Lesson Unit

Further Practice Idea

Since I seek the advice from a professional, then I would suggest you consider the same. If you are looking to extend the lesson to 5 days, then research and bring in (or Zoom/Google Meet/Skype in) a tax professional. Prep them for presenting by informing them that they will need to use basic vocabulary, explain terms that they would normally use without thinking twice (like refund or withholding), and to offer suggestions for places for new tax filers to get help completing their taxes in the area (or websites they trust).

***Remember, tax season is an extremely busy time for these professionals, so you may have more success getting a volunteer between April 17th-December 31st.

Search for some tax professionals here:

Ultimate Goal of the Lesson Unit

If students know the importance of filing their taxes and the yearly ‘due date’ then I would consider the lesson to be a raving success! To me, it’s not about having students understand HOW to fill out their taxes, it’s about knowing that they need to do it and where to go to get the support they need to do it right (advocacy in real life, folks).

Filing Taxes Lesson Unit

May I Also Suggest Teaching

Since filing income tax directly relates to Income and Income tax, I would work those two lesson units into your curriculum. Be sure to cover those topics before delving into Filing Taxes.